It is usually segmented into tax brackets that progress to successively higher rates. Proportional tax also referred to as a flat tax affects low- middle- and high-income earners relatively.

How Texas Taxes Sustain Inequality Texas Signal

What statement BEST describes the use of mass transit in Texas.

. For example the federal income tax rates. Texas Government Test UT Austin 510 Terms. The federal income tax rates for 2005 listed in the table below show for instance that the first 7300 earned by a single individual is taxed at the 10 percent rate.

Progressive taxes are imposed in an attempt to. A good example of how income taxes can be progressive is provided by the current federal income tax system. Say their 120000 in income was taxed at 24 which would be 28800.

The Texas Politics Project. If an individual who is currently in the 12 percent tax bracket would like to work extra hours or take a second job they could end up facing the 22 percent bracket on their extra earnings. The high income tax states like California Hawaii and New York have top brackets in the 9 to 11 percent range.

In a progressive tax system a taxpayer. A progressive tax is a tax in which the tax rate increases as the taxable base amount increases. The term progressive describes a distribution effect on income or expenditure referring to the way the rate progresses from low to high where the average tax rate is less than the.

Which of the following statements most directly supports the use of social welfare programs. That essentially means they use the opposite of a progressive tax system. Which of the following best describes a progressive tax.

The 2017 tax law limits deductions for state and local taxes to 10000. Currently there is no mass transit infrastructure set up in. A progressive tax is a tax in which the tax rate increases as the taxable amount increases.

A progressive tax is based on the taxpayers ability to pay. But existing law also allows up to 2 percent more for. A flat tax on the other hand gives all taxpayers the same average tax rate regardless of income while a regressive income tax would give taxpayers lower average tax rates as their incomes increase.

Progressive and regressive tax systemsThe Texas Politics Project. The next 22400 up to 29700 is taxed at 15 percent and so on. Most income tax schemes.

Learn about the definition pros and cons and significance of the progressive tax. Progressive taxes require those with higher incomes to pay a higher percentage of their income on those particular taxes. This acts as a negative incentive on working more.

The impact of regressive taxes is exactly the opposite. For a tax to be progressive the average tax rate paid by an individual increases as their income increases. A progressive tax is a tax system that increases rates as the taxable income goes up.

It imposes a lower tax rate on low-income earners than on those with a higher income. A progressive tax policy requires individuals with higher incomes and wealth to pay taxes at a rate that is higher than those with lower incomes. The lower-income person might pay 10 or 1200 in taxes leaving them with 10800 to cover all of their needs.

For example a progressive tax rate may move from 0 to 45 from the lowest and highest brackets as the taxable amount increases. Texas Politics 85 Terms. The 2005 state sales tax rate in Texas was 625 percent for the state rate.

The regressive tax revenue system provides benefit to people with high earning since they are not required to pay large amount of taxesJod16Ext13 The tax system in Texas is most regressive and Texas is the 3 rd state in United States which have most regressive tax revenue system. A state constitutional amendment requires that the electorate approve an income tax by referendum. Which of the following best describes a progressive tax.

Poverty is a systemic problem beyond the control of individuals and limiting the effects of poverty on children is the best way to give them a chance at escaping poverty in their own lives. The person with the higher income would pay a higher tax rate. Texas Government 2306 Chapter 4 Legislative Organization and Process 40 Terms.

The term progressive refers to the way the tax rate progresses from low to high with the result that a taxpayers average tax rate is less than the persons marginal tax rate. Regressive taxes have a greater impact on lower-income individuals than the wealthy. Which of the following best explains why local taxes in Texas are higher than in most other states.

The average tax rate is lower than the marginal tax rate. They would be taxed differently under a progressive tax system. This is usually achieved by creating tax brackets.

Tax rates that increase as income increases. In a progressive tax system the wealthy pay a larger portion of their income in taxes. In the past decade the meaning of all men are created equal has been expanded to include women and all.

Texans remain unreceptive to using mass transit and only about 5 percent use it on a regular basis. It is unlikely that Texans will have an income tax in the foreseeable future because. All tax schemes can be characterized as either progressive or regressive.

Property and sales tax rates are generally the same for everybody. As you can see in the image below Texas is a center right state. In February of 2018 the University of Texas Texas Tribune Poll surveyed 1200 registered voters and asked respondents to self identify on a scale from 1 to 7 where 1 is extremely liberal 7 is extremely conservative and 4 is exactly in the middle.

No Income Tax States Some states -- Alaska Florida Nevada South Dakota Texas Washington and Wyoming -- dont collect any income taxes. In my viewpoint Texas should adopt the progressive tax. Mass transit is extremely popular in Texas with more than 40 percent of Texans using it on a regular basis.

Progressive taxes mean that as an individual earns more they will face higher rates of tax. The progressive tax system is a form of taxation in which the tax rate increases as personal income increases. They require those with lower incomes to pay a higher percentage of their income on such taxes.

The term can be applied to individual taxes or to a tax system as a whole.

Texas State Taxes Forbes Advisor

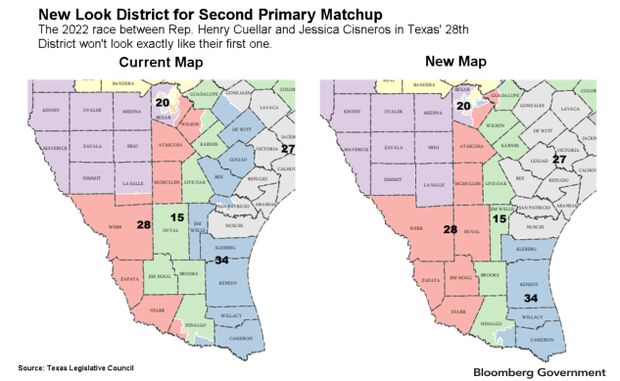

South Texas Rematch Pits Centrist Incumbent Against Progressive Bloomberg Government

America S Future Is Texas The New Yorker

Tax The Rich Progressive Activist Mens T Shirt In 2022 Mens Tshirts Mens T Mens Shirts

0 Comments